In the competitive world of private equity (PE), where success hinges on securing capital from investors, every aspect of communication is critical. However, many private equity firms underestimate the value of strategic communications, focusing more on financial engineering and deal-making than the messaging and image they project to investors. In today’s market, where transparency, reputation, and investor relations play an outsized role in fundraising activities, private equity firms need to invest in strategic communications expertise.

This blog will explore the importance of strategic communications for PE firms, particularly during fundraising campaigns, providing key insights on how effective messaging, reputation management, and proactive engagement with stakeholders can be game-changers for attracting and retaining investors. We will also dive into a case study illustrating how things can go wrong when strategic communications are neglected, and how firms can turn potentially negative narratives into positive outcomes.

The Role of Strategic Communications in Private Equity

Private equity firms are increasingly operating in a landscape where they must balance their financial prowess with a clear, compelling narrative that resonates with investors, regulators, portfolio companies, and the media. Strategic communications help firms navigate this complex environment, ensuring their messaging aligns with their long-term goals and addresses the concerns of key stakeholders.

According to a 2022 survey by Private Equity Wire, only 30% of private equity firms engage external strategic communication partners during their fundraising efforts. This figure is surprisingly low, considering the high stakes involved in securing capital commitments from limited partners (LPs). The same survey found that 62% of institutional investors listed reputation and transparency as significant factors in their decision-making process when selecting a private equity fund to invest in.

Key Benefits of Strategic Communications

- Enhancing Investor Confidence and Trust The private equity fundraising process can be daunting for potential investors, many of whom commit significant portions of their portfolios to long-term illiquid investments. Clear and consistent messaging through strategic communications can ease investor concerns, ensuring transparency about the fund’s performance, objectives, and governance practices. It also fosters trust, a critical element in investor relations.

- Reputation Management and Crisis Communication In an era where negative press can travel fast and damage a brand’s reputation overnight, strategic communication teams play an essential role in preemptively managing and mitigating potential crises. Whether it’s addressing concerns around the firm’s environmental, social, and governance (ESG) impact or responding to criticisms of a firm’s corporate culture, strategic communications help craft responses that protect and enhance a firm’s reputation.

- Targeted Fundraising Messaging Every private equity firm has a unique value proposition, but articulating it clearly to different types of investors requires expertise. Whether the firm specializes in technology startups, real estate, or distressed assets, strategic communications experts tailor messaging to resonate with various investor profiles, ensuring that the firm’s strengths and vision are aligned with what specific investor groups are looking for.

- Navigating Regulatory and Media Relations As private equity firms grow, their operations become subject to increased regulatory scrutiny and media attention. Having a strategic communications team in place ensures that a firm can navigate complex regulatory frameworks and maintain a positive public image while avoiding potential pitfalls.

Data on the Use of Strategic Communications in PE Fundraising

Despite the benefits, a significant number of private equity firms still do not prioritize strategic communications. In fact, as previously mentioned, only 30% of firms use external communications professionals during their fundraising activities, and less than 50% have a dedicated in-house communications team.

A study conducted by Preqin in 2023 highlighted that 42% of institutional investors declined to invest in a private equity firm because of concerns related to transparency and poor communication. This finding underscores the risks PE firms face when they neglect to engage professional communication teams.

Case Study: How Poor Communications Can Hurt Fundraising Efforts

Let’s consider a real-world example of how the absence of strategic communications expertise can lead to serious consequences for private equity firms.

Case Study: A PE Firm with a Toxic Workplace Culture

A mid-sized private equity firm in the U.S. was poised to raise a new fund after a series of successful investments in the healthcare sector. However, just as the firm began its roadshow to attract institutional investors, several former employees took to online forums and social media, publicly criticizing the firm’s aggressive culture. These employees described the environment as “toxic,” citing long hours, cutthroat competition, and a lack of work-life balance.

The firm initially ignored the negative remarks, assuming that their solid performance track record would outweigh any concerns about their corporate culture. However, the news quickly gained traction in the media, with stories emerging about the firm’s allegedly unethical treatment of employees. The negative press began to affect their fundraising efforts as investors raised concerns about the firm’s management practices and its ability to retain talent.

This is where strategic communications expertise could have played a pivotal role. By engaging a team of professionals early on, the firm could have taken proactive steps to manage its reputation. Here’s how strategic communications could have helped:

- Preemptive Media Strategy The firm could have worked with communications experts to craft a compelling narrative that addressed concerns about its workplace culture before the story gained traction. A well-thought-out media strategy would have allowed the firm to present its side of the story, perhaps highlighting recent changes to its HR policies and focusing on the positive aspects of its culture.

- Internal Communications and Employee Engagement The firm could have used strategic communications to improve internal engagement and morale. By addressing the concerns of current employees, the firm could have mitigated the risk of negative reviews being posted online in the first place.

- Repositioning the Firm’s Aggressive Culture Rather than allowing the aggressive culture narrative to spiral out of control, the firm could have repositioned it as a competitive advantage. Strategic communications professionals could have helped the firm frame its culture as one that emphasizes high performance, results-driven leadership, and entrepreneurial spirit, while also acknowledging and addressing areas of concern.

- Crisis Communication During Fundraising Once the negative press started to affect fundraising activities, strategic communications experts could have been deployed to engage directly with concerned investors. This would have included transparent communication about the steps the firm was taking to address the issue, potentially saving the fundraising campaign from further damage.

Turning Negative Press into Positive Momentum

A well-executed strategic communications campaign can turn a negative situation into an opportunity for growth. By addressing workplace culture concerns head-on, private equity firms can reshape their image in the eyes of investors and the public. For example, firms can emphasize their commitment to improving employee well-being and fostering a collaborative, results-driven environment.

A firm that uses strategic communications to highlight its strengths while being transparent about its challenges demonstrates resilience and leadership—qualities that attract investors.

Observations on the Strategic Communications Gap in Private Equity

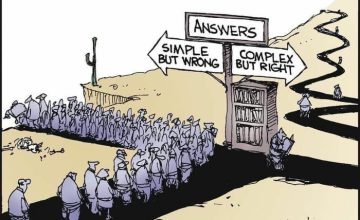

Despite the clear benefits, there is a significant gap between the use of strategic communications and the demand from investors for transparency, reputation management, and clear messaging. This gap presents an opportunity for private equity firms to gain a competitive edge by investing in professional communications expertise.

Given that 60% of institutional investors cite transparency as a key factor in their decision-making process, firms that fail to prioritize strategic communications are leaving money on the table. Moreover, in an era of heightened scrutiny on issues such as ESG, diversity, and governance, private equity firms can no longer afford to neglect how they communicate with the outside world.

Summary: Strategic Communications as an Insurance Policy for Fundraising

In conclusion, strategic communications should be viewed as an essential insurance policy for private equity firms engaged in fundraising activities. By investing in strategic communications, firms can enhance their reputation, build trust with investors, manage crises, and position themselves as leaders in their industry. The cost of neglecting strategic communications can be high, as seen in our case study, where poor handling of a negative narrative affected the firm’s ability to raise capital.

As private equity firms look to raise larger funds and compete in an increasingly global marketplace, those that invest in strategic communications expertise will be better equipped to navigate the complexities of investor relations, regulatory scrutiny, and media attention. The return on investment for strategic communications is clear: better investor engagement, enhanced reputation, and, ultimately, more successful fundraising campaigns.

Strategic communications isn’t just a nice-to-have—it’s a must-have for any private equity firm that wants to stay competitive in today’s fast-paced, reputation-driven market.